The cargo volume handled remains a key performance indicator for ports. While also other indicators related to logistics performance, sustainability, innovation and economic impact are gaining ground, it remains relevant to observe how cargo volumes have evolved over time. The table shows the top 15 container ports in the European Union in 2016 based on container throughput expressed in TEU. It also includes container growth figures compared to 2015 and pre-crisis year 2007. The listed ports all handle more than 1.5 million TEU.

What do the figures reveal?

Top 15: y-o-y increase in container traffic of 2.1% in 2016 (-1.6% in 2015)

While in 2015 the top 15 ports still saw a small traffic decline of 1.6% compared to 2014, this time we have a modest growth of 2.1%. Barcelona, Sines, Piraeus, Algeciras and Antwerp record the highest y-o-y growth figures, while Felixstowe, Le Havre and Bremerhaven are the only ports with a traffic loss in 2016.

Top 15: 14.4% increase in container traffic between 2007 and 2016

The top 15 ports combined saw a rather unimpressive 14.4% increase in container traffic compared to pre-crisis year 2007. In nearly a decade, four of the 15 ports recorded container volumes in 2016 which still remain below the 2007 figures. Gioia Tauro and Barcelona are special cases combining a strong growth in 2016 with 2016 figures well below the 2007 container throughput.

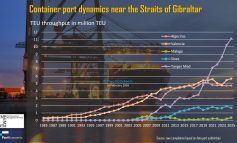

2007-2016: South European ports with a substantial transhipment focus show strongest growth

Star growers during the 2007-2016 period are found in southern Europe: Sines (9 times more volume), Piraeus (+168%), Marxaxlokk, Valencia and Algeciras. It mostly concerns ports which heavily rely on sea-sea transhipment volumes. When it comes to ports with a much stronger gateway/hinterland orientation, Antwerp and Genoa are the strongest growers.

Piraeus and Sines most notable newcomers

Only few changes took place when it comes to the ports that made it to the top 15. Piraeus was not in the top 15 in 2007. In that year, Constantza ranked no. 15 (1.41 mio TEU) and Zeebrugge no. 11 (2.02 mio TEU). Sines joined the top 15 only in 2016 filling the spot previously occupied by Zeebrugge (1.56 mio TEU in 2015).