By Theo Notteboom

Last week, the Rotterdam Port Authority presented the port’s cargo throughput figures for 2017. With a 10.9% y-o-y growth, the Dutch port handled 13.73 million TEU in 2017. The strong results in 2017 reinforced Rotterdam’s position as the largest European container port, followed by Antwerp (10.45 million in 2017, a growth of 4.1%), Hamburg (8.82 million TEU, -1%), Bremerhaven (5.54 million TEU, +0.9%) and Valencia (4.83 Million TEU, +2.3%).

With a 10.9% y-o-y growth, the Dutch port handled 13.73 million TEU in 2017.

With these strong growth figures, you might get the impression that Rotterdam is becoming an increasingly dominant player on the European container port scene. For example, Rotterdam now handles three times more containers than the fifth largest container port in Europe, and almost nine times the container volume of no. 15 in the European port ranking. Another striking observation: Rotterdam’s container volume is higher than the box volume handled by the entire Italian port system.

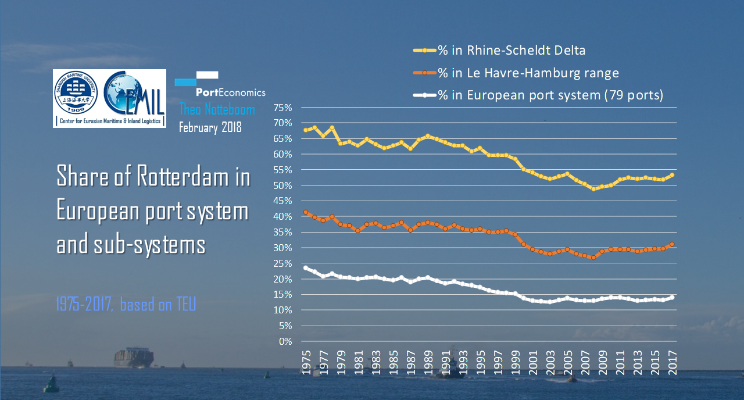

To evaluate whether we are truly witnessing a growing dominance of Rotterdam (or a ‘Rotterdamisation’ – a term I first coined a few years ago during a discussion with Porteconomics colleagues), the graph shows the long-term evolution (1975-2017) of the share of Rotterdam in the total throughput of the entire European container port system (based on a representative sample of 79 ports), the Le Havre-Hamburg port range (which includes all ports along the coastline between Le Havre in France and Hamburg in Germany), and the Rhine Scheldt delta (i.e. all ports in Belgium and the Netherlands, with Rotterdam, Antwerp and Zeebrugge as the main container ports).

The port of Rotterdam saw a downward trend in its container share between 1975 and 2008,

The port of Rotterdam saw a downward trend in its container share between 1975 and 2008, with a short-lived upsurge in 2004-2005. Rotterdam’s share dropped significantly around the start of the new millennium. In 2008, Rotterdam handled 48.6% of the total container throughput in the Rhine-Scheldt Delta, 26.8% of the volume of the Le Havre-Hamburg range and 12.9% of the total TEU handled in the entire European container port system.

The start of the financial and economic crisis brought an end to the downward trend.

The start of the financial and economic crisis brought an end to the downward trend. After a few years of stagnating shares, the Dutch mainport started to gradually increase its container footprint. The strong 2017 growth figures resulted in an increase of the port’s share to 53.2% of the total container throughput in the Rhine-Scheldt Delta, 31.1% of Le Havre-Hamburg range and 13.9% of the European container port system.

As a leading port, Rotterdam shares the responsibility to support the development of the European container port system towards a more efficient, sustainable, digital and resilient ecosystem.

The dynamics in alliance formation, the changing world economic geography, the realization of Maasvlakte II and the scale effects of the port have all contributed to the recent improvement of Rotterdam’s container throughput position. But at the same time, the European container port scene has become much richer with the rise of Med ports (Piraeus, Sines and Valencia to name but a few) and Baltic ports (such as Gdansk) and with it the multiplication of routing options available to shippers and shipping lines. It is expected that both nearby (Antwerp is only 100km away) and more distant seaports will increasingly challenge Europe’s number one container port. Rotterdam is not only determined to further improve its competitiveness. As a leading port, Rotterdam shares the responsibility to support the development of the European container port system towards a more efficient, sustainable, digital and resilient ecosystem.