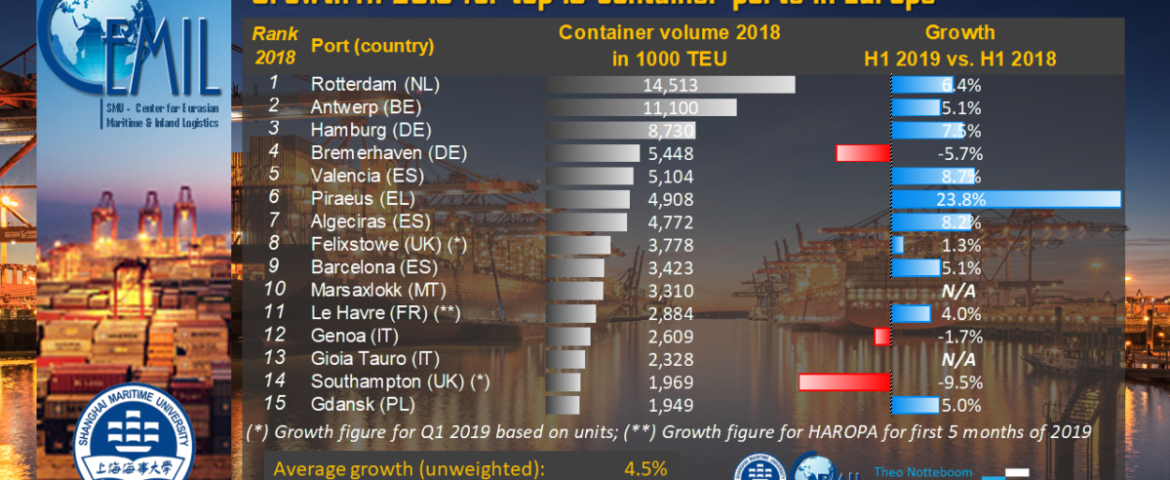

The table shows the top 15 container ports in the European Union in 2018 based on container throughput expressed in TEU and the year-on-year growth for H1 2019. No growth figures were available for Marsaxlokk and Gioia Tauro.

What do the figures reveal?

First, with an overall weighted average growth of 5.7% (4.5% unweighted), the top 15 ports are performing better than in 2018 (+4.2%), 2017 (+4.6%), 2016 (+2.1%) and 2015 (-1.6%).

Second, the top three ports recorded a weighted average growth of 6.3% in H1 2019 compared to 4.1% in 2018. While Rotterdam and Antwerp also saw healthy container volume increases in previous years, Hamburg succeeds in presenting strong growth figures for the first time in many years. Part of Hamburg’s growth comes from the arrival of new deepsea liner services at the expense of neighbouring Bremerhaven. Moreover, the ongoing deepening and widening of the Elbe river gives a positive signal to the container market. Hamburg’s growth has not stopped the rise of Gdansk. The Polish port is expected to pass the 2 million TEU mark this year.

Second, Piraeus continues its strong growth path of the past decade by recording an impressive 23.8% growth in H1 2019 compared to H1 2018. If this growth figure can be sustained throughout 2019, the Greek hub port will reach about 6 million TEU this year and climb to the fourth position in the European ranking. Note that Piraeus only handled 1.2 million TEU in 2010. Also Spanish ports Valencia, Algeciras and Barcelona remain on an upward growth curve. Barcelona was hit very hard in 2009 and had difficulties in regaining growth afterwards. However, the year 2017 brought a trend break in the Catalonian port and also last year the port recorded strong growth. Genoa presented impressive growth figures in 2017 (+14.1%), but Italy’s largest container port has difficulties to match the 2017 volume (-0.5% in 2018 and -1.7% in H1 2019).