By Theo Notteboom

Impact of COVID-19 on European ports only started to be strongly visible in March 2020.

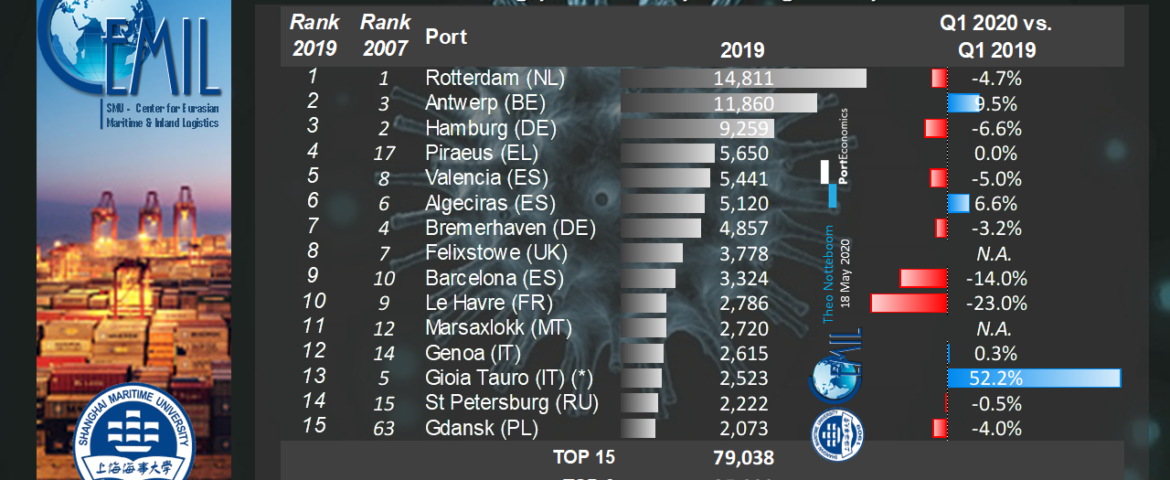

The table shows the container throughput growth for Q1 2020 in the top 15 containers ports in Europe. While the Coronavirus emerged in China in December 2019, its impact on European ports only started to be strongly visible in March 2020. In February 2020, the supply shock in China, where the factories were unable to operate, generated a first wave of blank sailings. Given the sailing time on the Europe-Far East trade, the effect of these blank sailings could only be observed by March 2020. In mid-March, the whole picture turned around: the supply side really built back up nicely in Asia, but a demand shock in Europe emerged due to the full and semi lockdown situations in virtually all European countries. This has led to an additional wave in blank sailings with carriers withdrawing up to 20% of their network capacity on the main trade lanes and idling more than 2.5 million TEU of fleet capacity. For some ports, the blank sailings imply 20% to even up to 50% less vessel calls for April and May 2020, although for most ports the impact is mainly visible on the main trade routes (FE-Europe) and not so much on other trade routes. This second wave of blank sailings will significantly affect Q2 2020 volumes in European ports, but does not show in the Q1 2020 figures.

Gioia Tauro, Antwerp and Algeciras record strong growth

Despite the fact that the COVID-19 crisis only partially affected the Q1 2020 throughput figures, most ports recorded negative growth figures. Mediterranean transhipment hubs Gioia Tauro and Algeciras and the mixed transhipment-gateway port of Antwerp are the only ports posting strong growth figures. In the Summer of 2019, Terminal Investment Limited (TiL) became the full owner of Medcenter Container Terminal (MCT) at Gioia Tauro after it acquired the 50% stake from Contship Italia. This move now starts to have its effects with more MSC container flows being directed via Gioia Tauro. The port of Algeciras handled 6.6% more containers in Q1 2020 compared to the same period last year. This is in line with the 7.3% growth in 2019. The port of Antwerp recorded strong growth on all trade routes except for the Far East (-2.2%). Note that the Belgian coastal port of Zeebrugge (no. 18 in Europe in 2019) also recorded strong growth in Q1 (i.e. plus 11.1%) mainly as a result of the additional volume generated at the terminal of Cosco Shipping Ports. The strong throughput performance of the Belgian container ports of Antwerp and Zeebrugge is in sharp contrast to the moderate to strong volume drops in the other hub ports of the Le Havre-Hamburg range, such as Rotterdam (-4.7%), Hamburg (-6.6%), Bremerhaven (-3.2) and Le Havre (-23%).

Strong performance of Antwerp in sharp contrast to the situation in other hub ports of the Le Havre-Hamburg range

Le Havre and Barcelona were confronted with a steep decline in container volumes in Q1 2020. Le Havre initially was heavily affected by the French national strike during December 2019 and January 2020. In March 2020, the port’s strong exposure to trade with China further affected its first quarter results. The French port is trying to bounce back. In early March an agreement was signed to implement a recovery plan in response to disruptions caused by the strike. Le Havre also announced its intention to merge with its HAROPA partner ports of Rouen and Paris by 21 January 2021. The 14% drop in Barcelona is almost fully attributable to a 27% decline in transit traffic. Import/export containerised cargo flows in the Catalan port only decreased by 3.2%. Valencia had to accept a 5% volume drop.

Abrupt disruption in steep growth curves of Piraeus and Gdansk

Another remarkable result is the moderate TEU decline in Piraeus. The Cosco-owned Greek hub port realized strong growth figures in the past ten years which resulted in a rise to a no. 4 position in the ranking in 2019. Also the port of Gdansk, another fast climber in the European container port ranking, recorded a negative growth figure for the first time for many years. The first quarter TEU throughputs in the Italian port of Genoa and the Russian port of Saint-Petersburg were at the same level as in the same period last year.

Q2 2020 results are expected to be worse than the Q1 2020 results.

The Q2 results are expected to be worse than the Q1 results. As mentioned earlier, the second wave of blank sailings is hitting European hub ports. While more and more countries are relaxing the lockdown measures which were implemented in March, normal flow patterns are still disrupted leading to logistical challenges related to the repositioning of equipment (ships, boxes). Despite the negative volume prospects for Q2 2020, the TEU volumes in some European ports will benefit from the programs implemented by carriers to slow the flow of trade for shippers who are unable to take deliveries amid the crisis (e.g. “suspension of transit” “detention in transit” or “storage in transit” which allow the customer to adapt the delivery date).