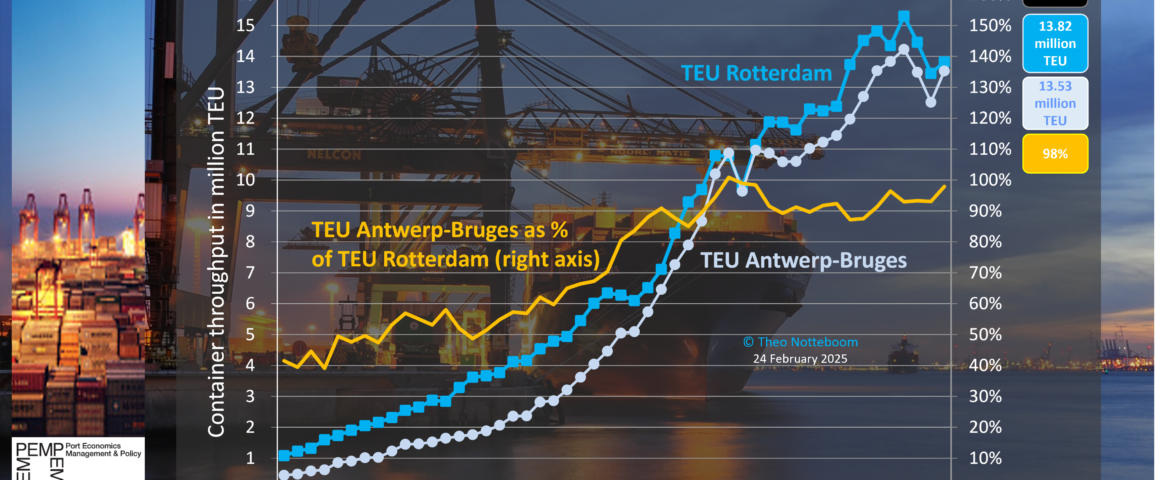

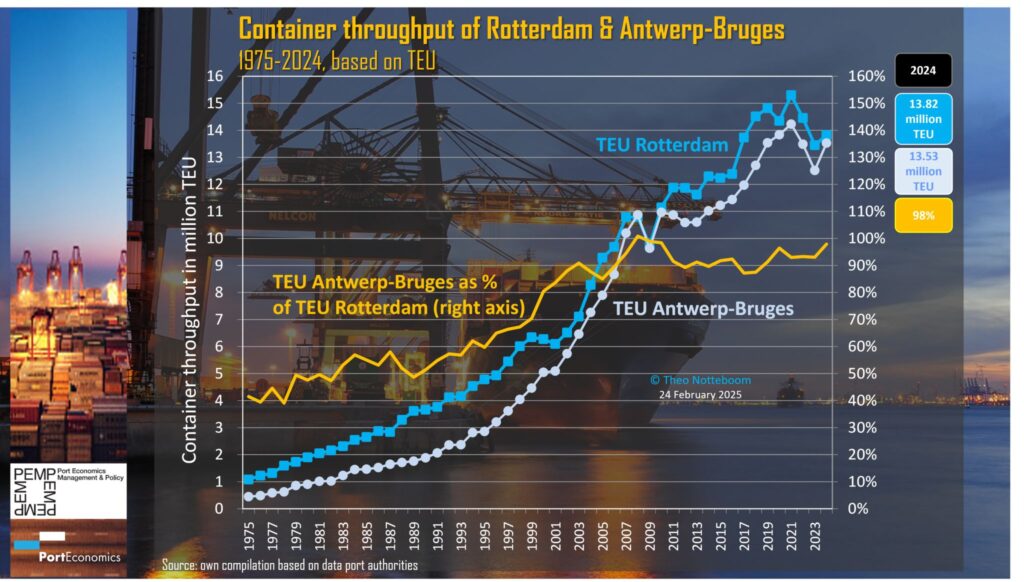

Theo Notteboom, PortEconomics co-director, analyses the evolution of container throughput at Rotterdam and Antwerp-Bruges over the past five decades and reveals a significant shift in European port dynamics. While Rotterdam has historically been the dominant container hub, Antwerp-Bruges has steadily increased its share, now nearly matching Rotterdam’s volume.

As Theo Notteboom analyses:

“The ports of Rotterdam (NL) and Antwerp-Bruges (BE) are situated in the Rhine-Scheldt Delta, the most significant multi-port region in Europe in terms of cargo volume. Over the past decade, both ports have placed a strong emphasis on their roles as hubs for promoting sustainability, energy transition, the circular economy, and security. As a result, traffic volumes have become just one of many KPIs used to measure a port’s success.

Still, handling maritime cargo volumes remains a fundamental activity for both ports. Rotterdam and Antwerp-Bruges remain the two largest container ports in Europe by a considerable margin. Interestingly, the gap between these two container giants has narrowed significantly: last year, Rotterdam handled 13.82 million TEU, while Antwerp-Bruges processed 13.53 million TEU.

This situation is not unprecedented. Belgian container ports, including Antwerp and Zeebrugge (which merged in 2022), made significant strides toward closing the gap with Rotterdam during the 1990s and early 2000s. In 2008, the gap was effectively eliminated, but since 2011, the difference in traffic volumes increased rapidly. Following the onset of COVID-19, Antwerp-Bruges gradually began to close the TEU gap with Rotterdam once again.

Supply and demand factors will influence the future of these container ports. On the demand side, the disruptive global geopolitical situation will undoubtedly affect trade routes and relationships. The declining competitiveness of industrial activities in Western Europe is not benefiting the container business, leading these ports to anticipate the content and impacts of the Clean Industrial Deal and the renewed EU port strategy.

Liner shipping dynamics will also play a role, especially after the reshaping of the alliance landscape earlier this year. The Gemini cooperation between Maersk and Hapag-Lloyd has chosen to concentrate cargo in a limited number of hubs, such as Rotterdam and Bremerhaven, which negatively affects Antwerp-Bruges. However, the service networks of standalone MSC, the Premier Alliance, and the Ocean Alliance are likely to lead to a more balanced TEU distribution between both ports.

On the supply side, the port of Rotterdam is undergoing the extension of the Maasvlakte 2 terminals and further upgrades at the Maasvlakte 1 terminals. Meanwhile, the port of Antwerp-Bruges is finalizing the last formal steps for the realization of the much-needed container terminal capacity extension (i.e., the ECA project), which will add at least 7 million TEU. Additionally, the Antwerp Gateway terminal is implementing its terminal automation program, and the Europa Terminal is increasing its capacity through ongoing quay wall renovations and the installation of automated stacking cranes. The COSCO-operated terminal in the Zeebrugge port area also offers room for further traffic development.”

Key findings of the database:

- Rotterdam handled 13.82 million TEUs in 2024, maintaining its position as Europe’s largest container port.

- Antwerp-Bruges handled 13.53 million TEUs, reaching 98% of Rotterdam’s throughput.

- Over the past decades, Antwerp-Bruges has continuously increased its market share, reducing the gap with Rotterdam.

- The trend highlights Antwerp-Bruges’ rising role as a major European container hub, with competition between the two ports intensifying.

As container traffic continues to evolve, the balance between these two leading ports will remain a key development to watch in the coming years.

The portgraphic illustrates the historical evolution of container throughput at Rotterdam and Antwerp-Bruges from 1975 to 2024, showcasing their long-term growth trends and competitive positioning.