By Theo Notteboom

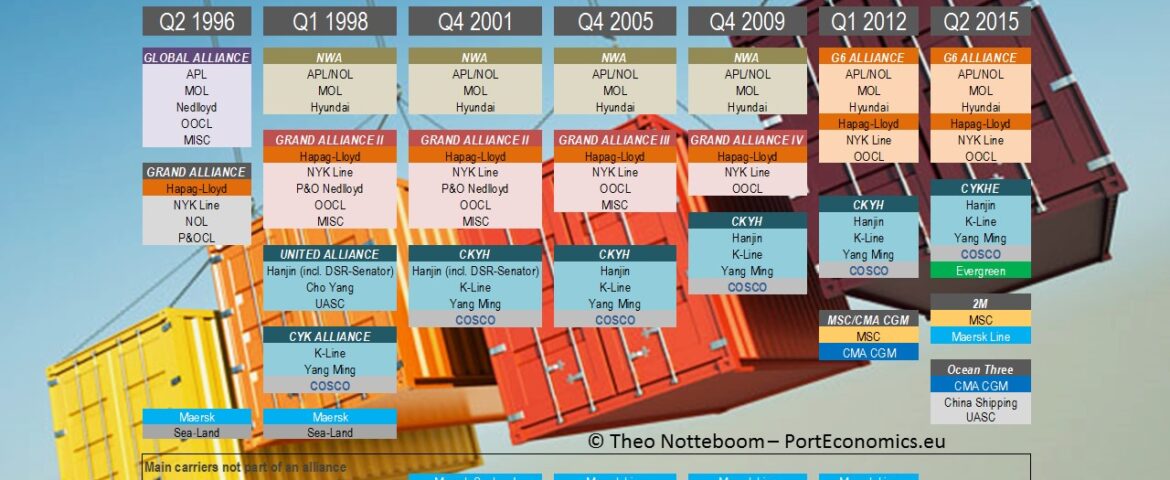

Operational co-operation between container shipping companies comes in many forms ranging from slot-chartering and vessel-sharing agreements to multi-trade strategic alliances. The first strategic alliances between shipping lines date back to the mid-1990s, a period that coincided with the introduction of the first post-Panamax containers vessels on the Europe-Far East trade. In 1997, about 70% of the services on the main East-West trades were supplied by the four main strategic alliances. Today, four large alliances are operational in the market: 2M, Ocean Three, CKYHE and G6 (a combination of the New World Alliance – NWA and the Grand Alliance). The main incentives for shipping lines to engage in strategic alliances are the need for critical mass in the scale of operation and the spreading of risks associated with investments in large container vessels. The alliance partnerships evolved as a result of mergers and acquisitions (e.g. merger between P&OCL and Nedlloyd and the take-overs of P&O Nedlloyd and SeaLand by Maersk) and the market entry and exit of liner shipping companies.

Initially, many of the largest carriers did not opt for alliance membership as these firms reached a sufficient scale allowing them to benefit from the same economies of scale and scope which strategic alliances offer. Top six carriers Maersk Line, MSC, CMA CGM and Evergreen are notable examples, while the remaining two top six carriers (i.e. COSCO and Hapag-Lloyd) have always opted for alliance membership despite the scale of their activities. A number of shipping lines such as Evergreen stayed away from alliances for reasons of commercial independence and flexibility. However, in more recent years even the largest shipping companies resort to alliances for their survival and to increase margins. The case of Evergreen demonstrates that even outsiders had to give in to alliance membership.

The graph clearly shows that strategic alliances are never lasting and thus subject to change. Individual shipping lines continue to show an increased level of pragmatism when setting up partnerships with other carriers on specific trade routes. The dance of the alliances is far from over and there seems no such thing as a fixed dance partner.