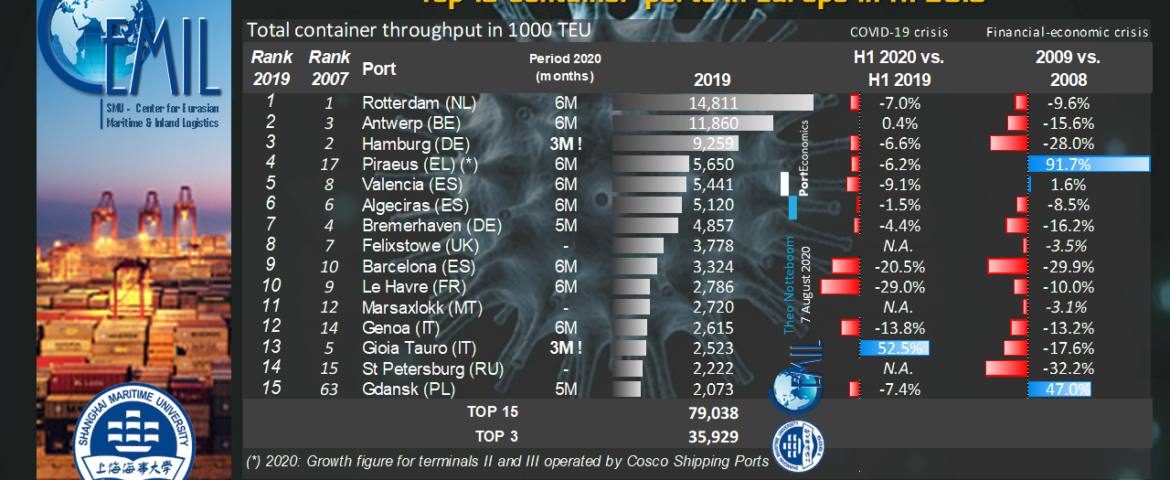

While the Coronavirus emerged in China in December 2019, its impact on European ports only started to be visible in March 2020 . The table shows the container throughput for H1 2020 in the top 15 container ports in Europe. Note that the figures for Hamburg and Gioia Tauro relate to Q1 2020 (H1 2020 figures are expected to be lower), while the figures for Gdansk and Bremerhaven only cover the first five months of 2020.

Antwerp is the only large gateway port in Europe which was able to reach a volume level comparable to last year

The port of Antwerp is the only large gateway port in Europe which was able to reach a volume level comparable to last year (+0.4%). Note that the other Belgian container port, Zeebrugge (no. 18 in Europe in 2019), recorded strong growth (i.e. plus 14% in H1 2020) mainly as a result of the additional volume generated at the terminal of Cosco Shipping Ports. Mediterranean transshipment hub Gioia Tauro is showing strong growth (H1 2020 figures were not in at the time of writing) as Terminal Investment Limited (TiL) became the full owner of Medcenter Container Terminal (“MCT”) at Gioia Tauro after it acquired the 50% stake from Contship Italia in the Summer of 2019. This move now starts to have its effects with more MSC container flows being directed via Gioia Tauro.

Vast majority of top 15 ports recorded negative growth figures, but large differences can be observed

As expected, the vast majority of the top 15 ports recorded negative growth figures in the first half of 2020. However, large differences can be observed with some ports such as Algeciras and Bremerhaven recording a rather modest decline, while others saw their TEU throughput drop by more than 20% (i.e. Le Havre and Barcelona). Le Havre initially was heavily affected by the French national strike during December 2019 and January 2020. In March and Q2 2020, the port’s strong exposure to trade with China further affected its results. Note that also French Med port Marseille (1.2 million TEU in 2019) had to accept a big volume drop of 17% in H1 2020. The sharp decline in Barcelona is largely attributable to a collapse of transit traffic. Import/export containerised cargo flows in the Catalan port were less impacted. Cosco-owned Greek hub port of Piraeus and the port of Gdansk in Poland, two fast climbers in the European container port ranking, both record negative growth figures for the first time since many years.

H1 2020 vs. 2009: the two crises had in many cases a very different impact on TEU growth

When comparing H1 2020 growth figures to 2009 growth figures, it becomes clear the two crises had in many cases a very different impact on container throughput development in the top 15 ports in Europe. Gioia Tauro and Antwerp were heavily affected by the financial-economic crisis which started in late 2008 (-17.6% and -15.6% in 2009 respectively) but is in a much stronger position during the COVID-19 crisis. A few ports such as Algeciras and Bremerhaven (and expectedly also Hamburg although H1 figures still are to be released) record much lower percentage losses in the first half of 2020 compared to 2008/2009. The 2009 crisis did not temper the rise of container ports like Valencia, Piraeus, and Gdansk, while the same ports were hit hard in H1 2020 by the pandemic. Container volumes in Barcelona and Genova seem to be very susceptible to crisis situations as they were hit hard in 2009 and again in H1 2020.