By George Vaggelas and Thanos Pallis

Τhe recent released data regarding the container throughput at the biggest Greek port, showed a decrease in the container volumes by almost 2,7% mainly due to the global economic environment. In many countries the trade has been severely impacted by the economic conditions which are characterized by increased inflation, reduction in consumption and disturbance in the supply-demand relationship.

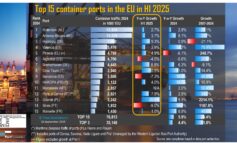

Despite the economic environment and the reduction in the container throughput, the port of Piraeus maintains its position as a hub in the Mediterranean area, being on the top-5 container ports in Europe and on the top-50 container ports globally. The port is well embedded in the global supply chains and shipping networks. We collected data regarding the container vessel calls at the port of Piraeus, aiming at unveiling elements of port’s connectivity. The port of Piraeus is able to facilitate even the biggest container vessel in the world fleet which is a crucial parameter of port competitiveness and a sign of port embeddedness in the global shipping networks. Figure 1 shows the biggest container ship calling at the port of Piraeus between 2016 and 2022.

FIGURE 1 – Biggest container vessel calling at the port of Piraeus (TEUs)

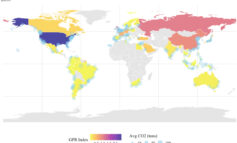

As shown in figure 1, the port of Piraeus is facilitating the biggest container vessels in the world fleet each year. Examining the vessels port calls directly before and after the port of Piraeus, unveils that in 2022 the biggest Greek port related to 28 countries (two less comparing to 2021), 15 of them being in Europe, 9 Asian countries 3 countries from Africa and one country from North America. The analysis concluded that the port of Piraeus is directly connected with 69 ports around the world (three less ports comparing to 2021). It is worth noted that the port of Piraeus relates to some of the major hub ports in the world like Singapore, Port Klang in Malaysia, Rotterdam and Antwerp. Figure 2 shows the connectivity density of Piraeus port at a country level.

FIGURE 2 – Density of Piraeus connections at a country level

The 26,8% of the monthly itineraries that the port of Piraeus facilitates, are coming from or destined to a Turkish port. In the second place i Italy with 12,5% of the itineraries directly connected with Italian ports. The list of the top-5 connected countries with the port of Piraeus is completed with Egypt in the third place (7,9%), Singapore (6,3% of the itineraries) and Cyprus (6,1%). It is worth noted that in comparison with the 2021 data, Greece is no longer in the top-5 of the countries whose ports are resenting a high connectivity with the port of Piraeus. The majority of the itineraries connecting Piraeus port with the abovementioned countries are served by feeder vessels, highlighting the role of Piraeus as a hub port in the East Mediterranean region.

At a port level, the 6,3% of the monthly itineraries are coming from or destined to the port of Singapore. The port of Nemrut (Turkey) and the port of Limassol (Cyprus) are holding the second place with 6,1% of the monthly calls while the port of Izmir (Turkey) follows with 3,8% of the calls. The list of top-5 well connected ports with the port of Piraeus is completed with the port of Antwerp in Belgium (3,6%). Thus, more than 1/4 (25,9%) of the container vessel calling at the port of Piraeus are coming from or destined to just five ports.

Focusing on the liner shipping companies using the port of Piraeus, COSCO is holding the first place with the 24,2% of the monthly calls. In the second place, there is MSC with 19,3% (comparing with 12% in 2021) while EVERGREEN holds the third place with 10,6%. The top-5 port users list is completed with CMA-CGM (8,7%) and Hapag-Lloyd (8,3%). In terms of Alliances the Ocean Alliance is the major partner of the port as 44,3% of the calls are coming from vessels of this alliance, showing that the operation of the port by COSCO, is attracting calls also from the other company members of the alliance. In the second place there is the members of the 2M alliance are counting for the 22,7% of the total calls while vessels of “The Alliance” are responsible for the 11%.

The vessel calls analysis shown the importance that COSCO plays in increasing port throughput, by attracting calls from the liner companies’ members of the same alliance. The continuous effort from the Piraeus Port Authority to exploit the port’s hinterland with of focus on the use of train services will increase the port’s hinterland connectivity, attracting additional traffic.

The article has been first published in the Supply Chain & Logistics magazine.